Demystifying the Blockchain Technology for Absolute Beginners

BACKGROUND

Imagine a world where you can send money directly to someone without a bank — in seconds and you don’t pay huge bank fees for your transactions. Or one where you store money in an online wallet not tied to a bank, meaning you are your own bank and have complete control over your money and where/when to spend it. A world where you don’t need a bank’s permission to access or move your financial asset, and never have to worry about a third party taking it away, or a government’s economic policy manipulating it.

Now beyond currencies, imagine if in this world, you had total control of your identity without fear of privacy violations and could mark all your online assets (songs, ebook, podcasts etc) and make them plagiarism and theft proof. In this world too, we would have a way to protect properties, real estates, important document and even track supply chains to ensure that we only use original goods and products from the manufacturer.

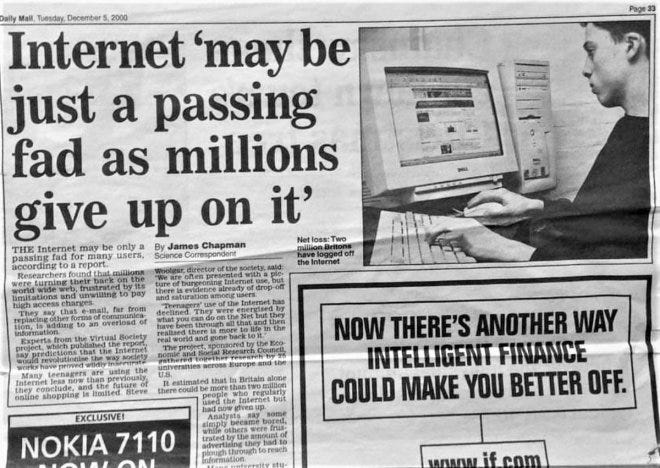

Well, this is no longer just a dream. The blockchain technology is already making all these possible and in fact we’re still unlocking more possibilities and we going to see more use cases rollout. We are still in the early days of the tech and just like the internet it is evolving at a very fast pace. So what is the blockchain tech all about? is it a hype or something to watch out for. Let’s dive in.

Courtesy: To my friend “Power Centre” who has always wanted to figure out what the technology I've been dabbling with is all about, you inspire me too with the things you can do.

Disclaimer: Blockchain is not cryptocurrencies. Read on to understand.

DEFINITION

The blockchain is a distributed decentralized ledger technology. What this means in simple terms is that it is distributed across several servers and not centralized, meaning that no single actor or entity has full control over the network. In a typical centralized network, a single entity manages all our data, transactions, etc but in a decentrailised network our data is duplicated across different nodes and as a result no one person has complete autonomy and control. The blockchain network is both decentralized and distributed. A visual explainer is seen below:

Some Useful terms in the blockchain space

When one delves into the blochain space, especially for a beginer who just wants to have an overview of the underlying tech it can feel overwhelming just like every other thing we try to understand for the first time. Briefly, I’ll define some terms that are peculiar to the blockchain ecosystem.

Private Keys:

A private key is a cryptographically generated value that is unique to a user on the network. It helps users manage their identity on the network. A user can generate a public key from their private key, they can then use this public keys to interact with the network, generate an address for receiving funds into their cryptowallet, sign transactions etc. The private key serves as the random bit of data that enables participants in the network to regain access to the network and track transactions related to their public keys and addresses. Bitcoin uses SHA-256 hashing algorithm to generate a 256 bit random number that serves as a users private keys.

Consensus:

In a decentralized distributed network, since there is no single actor it can be difficult to imagine how order can be maintained and how malicious participants in the network can be handled to ensure that the network runs efficiently. Well, consensus mechanisms help to solve this problem. For a long time the byzantine generals problem was a mathematical puzzle. For instance, imagine if you have 3 actors or participants in a network and they are supposed to tell you the content of a particular transaction that was broadcasted to their computers as this helps us to come to an agreement of which data is correct in the network. Some of the computers might decide to tamper with the transactions on their end in order to make gains or steal funds, so when we compare their data with others in the network we can come to an agreement that the data on majority of the computers must be the correct one. Remember that the network is distributed and copies are saved across different servers. So a consensus mechanism is a tool for ensuring uniformity of data across the network and ensures that malicious actors do not tamper with the network.

Consensus ensures that the different participants come to an agreement on the validity of the data in their seperate networks thus ensuring ‘TRUST’ and ‘TRANSPARENCY’. Different consensus mechanism exist.

Bitcoin and Ethereum for instance use a proof of work mechanism, cardano uses a proof of stake mechanism. Proof of Authority and Proof of elapsed time etc are other examples of consensus mechanisms on the network.

Mempool:

A mempool constitutes the collective of the RAMS on the network. It serves as the waiting place for transactions, because every transaction on the network needs to be validated into a block. Think of it as a bustop where students are loaded into a bus. The buses are the blocks on the blockchain and the students are new transactions waiting to be loaded, while the the bustop is the mempool or ‘Memory Pool’. When a bus is full, the students who could not get into the bus will have to wait to fill the next bus. Validators of transactions that need to be added to the blockchain are called miners. For each transaction they are able to validate they get a fee and this incentivizes them to keep mining.

Mining of this sort can be energy consuming especially in a proof of work consensus system, although other consensus systems handle it differently. To reduce the lenthiness of this article I’ll pause here on key terms.

THE GENESIS

Earlier this week, I wrote an article on how blockchains handle transactions using different account models and it sounded a bit overhead for beginners in the space. So I have decided to write a two part series one for beginners and another for developers who want to get into the blockchain space. So this article assumes that you are a total beginner. Next week I would write about the blockchain space with a target at developers and innovators. Join me as we explore the space.

On 18th August 2008, the domain name bitcoin.org was registered. Later that year, on the 31st October, a link to a paper authored by Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System was posted to a cryptography mailing list. This paper detailed methods of using a peer-to-peer network to generate what was described as “a system for electronic transactions without relying on trust”. This paper would later go on to be a game changer in the implementation of a cryptographically enabled distributed/decentralized system later called — “The Blockchain”.

On the 3rd of January 2009, the bitcoin network came into existence with Satoshi Nakamoto mining the genesis block of bitcoin (block number 0), which had a reward of 50 bitcoins. This first implementation of a peer to peer electronic cash system for transacting redefined finance and became a game changer for subsequent improvement and implementation of the technology.

Prior to this there had been earlier attempt to build similar structures. But one of the key issues was the double spending problem. Normally, if you send a song, video or an ebook to your friend over the internet, what you are actually sending across to them is a copy of the file. As a result, they end up having a copy while you still retain the original copy. This is awesome, would not work in finance (money).

Now, imagine if you have a balance of $100 in an E-wallet and decide to send it to a friend, they are supposed to gain $100 on their end while you get deducted and your balance reads $0. If sending of money on the internet is handled the same way we send songs then that means you would be able to spend your $100 multiple times and still have it. That defeats the characteristic of money and in finance it is called “double spending”.

To resolve the issue of double spending, banks and other financial institutions have been working as middlemen to verify transactions, balance the ledgers and ensure the smooth running of the system. This comes at a cost. The cost of your data, private information, vulnerability to governmental policies, control and centralization etc

For sometime the idea of taking this power from these centralized bodies remained a tough issue. How do you remove the middleman, automate the transaction handling process and still ensure that this platform is almost entirely hack and fraud proof and also fault tolerant, especially when you are handling transactions at scale.

Resolving the Issue

Bitcoin solved this problem by utilizing different tools to define a technology layer that could handle transactions and bring about decentralization and enure fault tolerance to assets. To build this kind of system a few issues had to be tackled in the 2008 paper, “Bitcoin: A Peer-to-Peer Electronic Cash System”.. Read Here: https://bitcoin.org/bitcoin.pdf

The abstract of the paper gave a summary on how the technology was set to solve the basic problems meant to birth the terrain of decentralized finance. It reads:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.

The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power. As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they’ll generate the longest chain and outpace attackers. The network itself requires minimal structure. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

The abstract above set the pattern and birted the decentralized/distributed network we now call the blockchain. It was only a kickstarter in the ecosystem as subsequent implementation of the blockchain technology brought in further improvement to the ecosystem.

WHERE WE ARE NOW

Bitcoin set to tackle the issues in decentralized finance but that is not all the blockchain tech is all about. Before we continue it is good you get this part early and I am going to write it again in bold caps : BLOCKCHAIN IS NOT CRYPTOCURRENCY.

In fact, cryptocurrency or the idea of a cryptographically secure digital medium of exchange was the foremost implementation where the blockchain technology was utilized. Today beyond the cryptocurrency space, the terrain is quite massive with different industry and business use cases. But, nevertheless the space has been shaped massively by the native currencies and tokens that run on some blockchain protocols and it has massivley incentivized alot of interests in the technology. As we speak there are over 2000 blockchain protocols and the number is increasing yearly with different ones promising something different.

When Bitcoin decided to build a structure to decentralize finance, it’s focus was on solving the key issues in finance by the launch of a cryptocurrency. The technlogy itself is capable of bigger possibilities just like in the early days of the internet. One might have said that webpages are the internet in the early 90’s but overtime the use of the internet and it’s possibilities has evolved to house even more complexities.

Today the blockchain is viewed as a fad by many but it might well go on to define a future we never thought possible.

In 2013, Vitalik Buterin proposed the idea of a blockchain that would be called “Ethereum”. By 2014, development was crowdfunded, and the network went live with an initial supply of 72 million coins on 30th July 2015. Gavin Wood later joined the Ethereum project as one of it’s co-founders and became the CTO. Gavin pushed the idea of a programmable blockchain in the ethereum yellow paper and that birthed the era of smart contracts and gradually evolved into apps that are capable of running on the ethereum virtual machine. Today, it is not strange to find mobile apps and website built on top the blockchain layer — these apps are called decentralized apps or dApps. The entire terrain is sometimes called web3.0; Web3.0 is usually referred to as an evolution of the web from cloud, apps and social based component — to a web where content is decentralized, immersive and users have control over their data.

This year the cardano blockchain has had a lot of success in building decentralised structures in Africa. From deploying an identity management system based of Atalla Prism with the capacity to manage the identities of over 5 million Ethiopians to building communication and payments systems off the blockchain tech with a vision to bank the unbanked.

As of today, beyond the space of cryptocurrencies the use cases of the blockchain technology has increased massively. The blockchain layer now supports different business and industry use cases spanning : supply chain, tracking trade transparency, web3.0, decentralized cloud, decentralized social networks, decentralized transport, identity management etc. A quick search on some of these terms on the net will yield astonishing results.

WHERE ARE WE GOING ?

At the moment it is not easy to clearly predict the future of the blockchain technology. But just as no one could predict decentralized apps in 2009, it keeps evolving. When the internet launched one could barely imagine the massive industry it serves today and it’s capability keeps evolving each day. One key point is that the blockchain technology is here to stay and we are in it’s early days.

The potentials are still very huge especially as we slowly evolve into a borderless world where borders are becoming thinner. The blockchain will be a tool that would give the average person total control of their assets in the digital space without fear of censorship by a central body. It will also serve as a tool for social change as it will allow people to amplify the voice of change and be confident in questioning the system without fear of having their bank accounts or digital assets being seized.

Looking forward to amazing content? Watch the space for more of my articles as I equally evolve in my personal journey in the blockchain space.

Lets connect too on twitter: HERE